ct estate tax return due date

Click here for Income tax filing information. Form CT706709 Connecticut Estate and Gift Tax Return is an annual return and covers the entire calendar year.

Basic Schedule D Instructions H R Block

And The due date for payment of the gift tax is the date nine months after the donors death.

. Estates Which Must File Only With Probate Court Form CT-706 NT Connecticut Estate Tax Return for Nontaxable. The due date for annual filers is January 31 for the previous calendar years sales. 13 rows Due Date for Estate Income Tax Return.

Do not use staples. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 2 million. The tax rate ranges from 108 to 12 for 2021 and from 116 to 12 for 2022.

CT-EITC - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040 Connecticut Income Tax Return on or before December 31 2021 you may be eligible for the 2020 EITC Enhancement Program click here for more information. 14 First and second quarter 2020 estimated payments are postponed until July 15. The tax applies only to the value of the estate above the threshold.

The Connecticut gift tax return is required to be filed on or before the last date including extensions for filing a Connecticut estate tax return with respect to the donor. 77-614 substituted commissioner of revenue services for tax commissioner effective January. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Connecticut no longer follows the federal gift tax return filing. A resident estate is an estate of a decedent who was domiciled in. Simplify Connecticut sales tax compliance.

The 2019 Form CT- 706709 Connecticut Estate and Gift Tax Return filing and payment date is extended to July 15. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million. File Only With Probate Court Rev.

Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates For estates of decedents dying during calendar year 2020 Read instructions before completing this form Do not use staples. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. The estate tax is due within six months of the estate owners death though a six-month extension may be requested.

Form CT-706709 for returns due between April 1 2020 and July 15 2020. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. All decedents estates required to file an estate tax return in Connecticut are presumed to have been resident in Connecticut at death and the burden of proof is on the decedents estate to prove.

Mailing address number and street apartment number suite number PO Box City town or post office StateIf town is two words leave a space between the words. An example of. Form CT-706709 Connecticut Estate and Gift Tax Return 2020 CT-706709 Taxpayers must sign declaration on reverse side.

When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a. There is no extension for the June 15 estimated payment due date for corporations. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 71 million.

Form CT-1120ES for any estimated payments due between March 15 2020 and July 15 2020 Estate Tax Return Payment. Complete return in blue or black ink only. The estate tax rate is progressive and payable on the value of the entire taxable estate.

Steps to Completing Section 1 - Gift Tax. The gift tax return is due on April 15th following the year in which the gift is made. Corporation Tax Return Payment.

0620 State of Connecticut Decedents last name First name and middle initial Social Security Number SSN. Form CT-1120 CT-1120CU for returns due between March 15 2020 and July 15 2020 Corporation Tax Estimated Payments. 1971 act changed deadline for payment from 18 to 9 months from date of death effective July 1 1971 and applicable to estates of persons dying on or after that date estates of persons dying before July 1 1971 are subject to estate tax laws applicable before that date.

Section 1 - Gift Tax. Generally the estate tax return is due nine months after the date of death. File your 2019 Form CT706709 on or before April 15 2020.

Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date including extensions of Form 706 or the date of filing Form 706 if the return is filed late. Adjustment for any difference in its value as of the later date that is not due to mere lapse of time 26 USC. If your sales tax liability is more than 4000 for the prior 12-month period beginning July 1 and ending June 30 the Department will notify you in writing that you are being changed to monthly filing status.

That goes up to 91 million in 2022 and 114 million in 2023. For 2020 that threshold is 51 million. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold.

2021 Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates General Information For decedents dying during 2021 the Connecticut estate tax exemption amount is 71 million.

Irs Announces 2022 Tax Filing Start Date

Federal Income Tax Deadline In 2022 Smartasset

Secured Property Taxes Treasurer Tax Collector

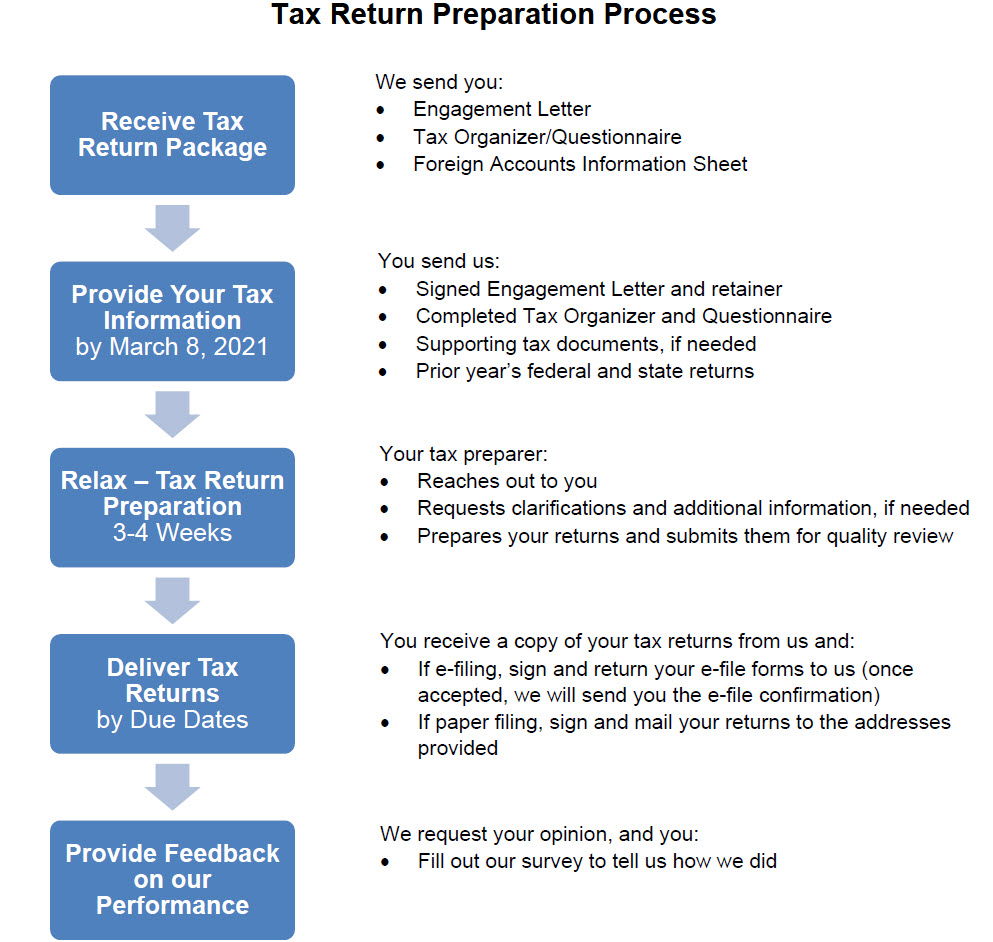

Tax Return Information The Wolf Group

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

When Are My Taxes Due The Official Blog Of Taxslayer

Due Dates Department Of Taxation

Tax Return Information The Wolf Group

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

Notice Of Late Rent Free Printable Documents Late Rent Notice Rental Property Management Room Rental Agreement

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

State Of Connecticut Revolutionary War Military Soldier Pay Document Huntington Ebay Military Soldiers Revolutionary War War

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Room Rental Agreement

When To File Form 1041 H R Block

The 2021 Tax Filing Deadline Has Been Extended Access Wealth